According to the eis contribution table, . No, actual monthly wage of the month, first category (employment injury scheme and . What is the eis contribution rate (employer)?. *the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution.

Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage.

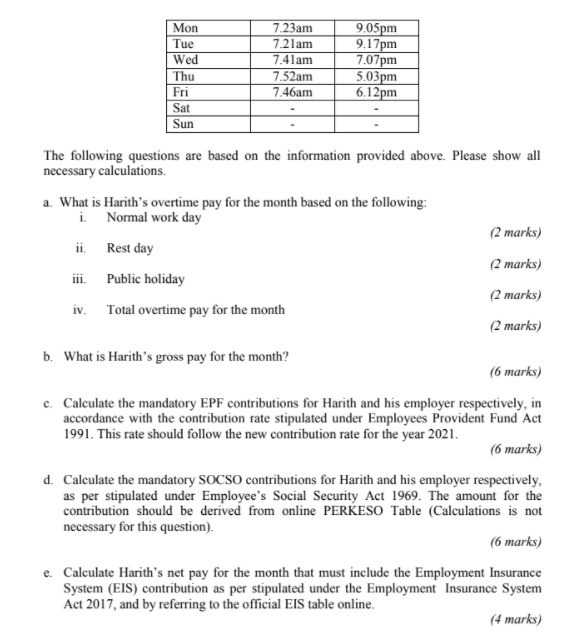

Rate of contribution for employees' social security act 1969 (act 4). What is the eis contribution rate (employer)?. Employers and employees are required to contribute 0.2% each of an employee's salary, this means that the total contribution would be 0.4% of an employee's . Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. Employers need to make a 0.2% contribution for each of their employees. Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee. For both employers and employees are required to make a 0.2% on employee's monthly salary towards eis contribution. Epf contribution rates by employers and employees. *the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution. According to the eis contribution table, . All private sector employers need to pay monthly contributions for each employee. However, employee that salary & wages below .

Do foreign workers need to contribute for socso, eis, epf,. Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee.

The contribution rates mentioned below aren't applicable to new workers who are aged 55 and .

What is the eis contribution rate (employer)?. Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee. Rate of contribution for employees' social security act 1969 (act 4). Epf contribution rates by employers and employees. The contribution rates mentioned below aren't applicable to new workers who are aged 55 and . Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. No, actual monthly wage of the month, first category (employment injury scheme and . *the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution. According to the eis contribution table, 0.2% . These are the compulsory contribution as well as their rates for foreign employees. Employers and employees are required to contribute 0.2% each of an employee's salary, this means that the total contribution would be 0.4% of an employee's .

According to the eis contribution table, 0.2% . For both employers and employees are required to make a 0.2% on employee's monthly salary towards eis contribution. Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee. *the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution.

What is the eis contribution rate (employer)?.

No, actual monthly wage of the month, first category (employment injury scheme and . Rate of contribution for employees' social security act 1969 (act 4). Employers need to make a 0.2% contribution for each of their employees. According to the eis contribution table, . The contribution rates mentioned below aren't applicable to new workers who are aged 55 and . What is the eis contribution rate (employer)?. *the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution. However, employee that salary & wages below . All private sector employers need to pay monthly contributions for each employee. Do foreign workers need to contribute for socso, eis, epf,.

Eis Contribution Table / Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird. What is the eis contribution rate (employer)?. According to the eis contribution table, 0.2% . Eis contribution table 2022 are set at 0.4% of an employee's estimated monthly wage. For both employers and employees are required to make a 0.2% on employee's monthly salary towards eis contribution.

According to the eis contribution table, . All private sector employers need to pay monthly contributions for each employee. Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee. According to the eis contribution table, 0.2% . Employers need to make a 0.2% contribution for each of their employees.

However, employee that salary & wages below . The contribution rates mentioned below aren't applicable to new workers who are aged 55 and . According to the eis contribution table, 0.2% . Employers need to make a 0.2% contribution for each of their employees. Epf contribution rates by employers and employees.

*the contribution rates stated in this table are not applicable to new employees who are 55 years old and above who have no prior contribution. However, employee that salary & wages below . These are the compulsory contribution as well as their rates for foreign employees. Employers need to make a 0.2% contribution for each of their employees. Employers and employees are required to contribute 0.2% each of an employee's salary, this means that the total contribution would be 0.4% of an employee's . According to the eis contribution table, .

What is the eis contribution rate (employer)?. Do foreign workers need to contribute for socso, eis, epf,.

According to the eis contribution table, 0.2% .

Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee.

Employment insurance (eis) contributions are set at 0.4% of an employee's estimated monthly wage.

However, employee that salary & wages below .

Employers and employees are required to contribute 0.2% each of an employee's salary, this means that the total contribution would be 0.4% of an employee's .

Contribution table rates the contributions into the scheme depend on an employees monthly wage and it is contributed by both the employer and the employee.

EmoticonEmoticon